sharply_done/E+ via Getty Images

Recreational boating felt the unfavorable impact of inflationary headwinds. And even a market giant like Brunswick Corporation (NYSE: BC) was not an exception. But with its well-balanced revenues and margins, BC showed why it remained a formidable contender. Also, its solid financial positioning shows it can sustain its operating capacity while covering borrowings and dividends. This aspect is vital today as market prospects become more optimistic despite the potential mild recession. Meanwhile, the stock price continues to increase after the sharp decrease last month. Even so, it is still lower than the intrinsic value of the company. As such, its upside potential remains attractive.

Company Performance

The recreational boating industry was one of those massively hit by pandemic disruptions. Due to health and safety restrictions, outdoor recreation was deemed non-essential. Despite this, the gradual reopening of borders and easing of restrictions led to revenge travel. It sped up for the following two years, and its positive spillovers stimulated industry rebound. Amidst all these changes, Brunswick Corporation remained unperturbed. Its growth did not falter even in 2020. And for the next three years, it maintained a solid market positioning as a formidable giant.

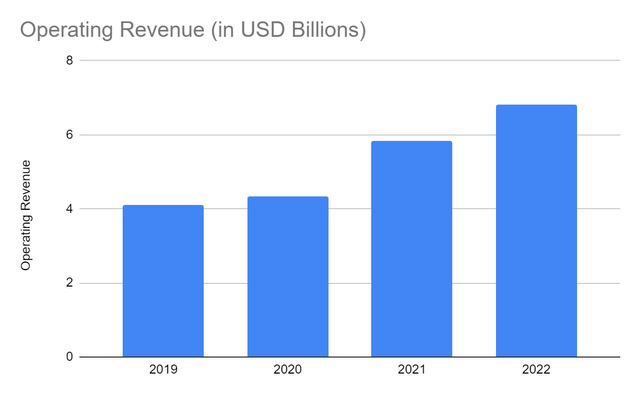

Brunswick ended 2022 with impeccable results. For instance, its robust performance was characterized by sustained revenue growth. Its operating revenue reached $6.81 billion, a 16% year-over-year growth. Propulsion remained its largest segment. But the boat segment became the primary growth driver. We can attribute it to various factors, mainly its continued capitalization on expansion. It allowed BC to increase and strengthen its domestic and international market presence. Also, its capital strategy enabled prudent investment in new products and technology. This move helped the company increase its operating capacity with improved efficiency.

Operating Revenue (MarketWatch)

Meanwhile, we can see that the actual growth slowed down. Inflationary headwinds and consumer behavior were the primary driving forces. First, boat shows returned in March 2021, leading to pent-up demand for recreational boating products and activities. Second, inflation peaked in 2022, which strained the budget of many customers. But the prudent pricing strategy cushioned the impact of inflation. It helped maintain its solid customer base by setting more flexible prices. Customers could still afford its products while ensuring that revenue could cover expenses. So despite the rising fuel prices, recreational boats had stable demand.

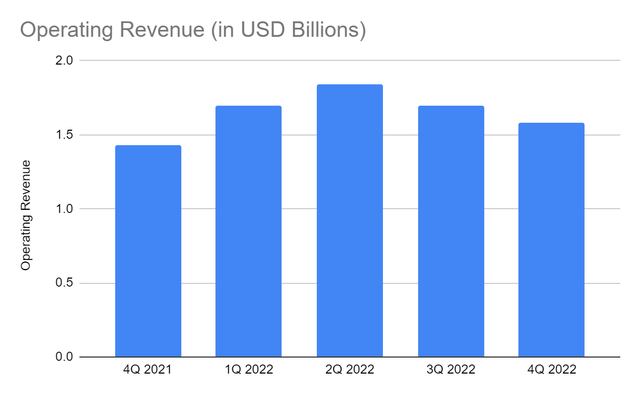

On a quarterly basis, we can take a closer look at the impact of inflation and seasonality. Its 4Q revenue reached $1.58 billion, a 10% year-over-year growth. And in all quarters, revenues grew substantially from the 2021 comparative quarters. Fortunately, it used inflation to its advantage through pricing and investment strategies. It was able to set more favorable pricing since boat shows in most parts of Asia returned in 2022. Note that it had two manufacturing operations in East Asia and one regional office in the Middle East. Even in other regions like Australia, the frequency of boat shows rose in 2022. Hence, the introduction of new products and increased operating capacity in other regions paid off. The only drawback of inflation was the unfavorable currency change in 4Q since BC operates in over twenty countries. It was logical to point it out since boat shows are more frequent during fall.

Operating Revenue (MarketWatch)

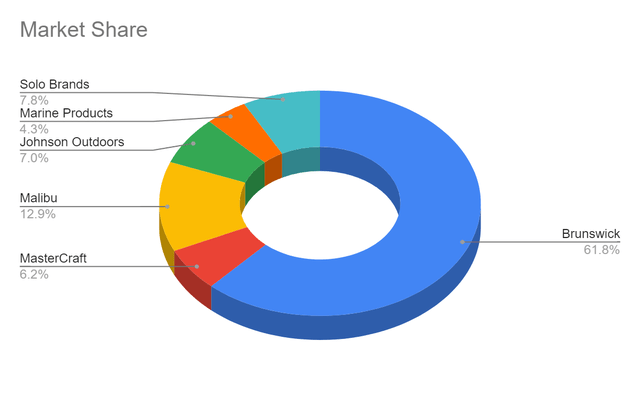

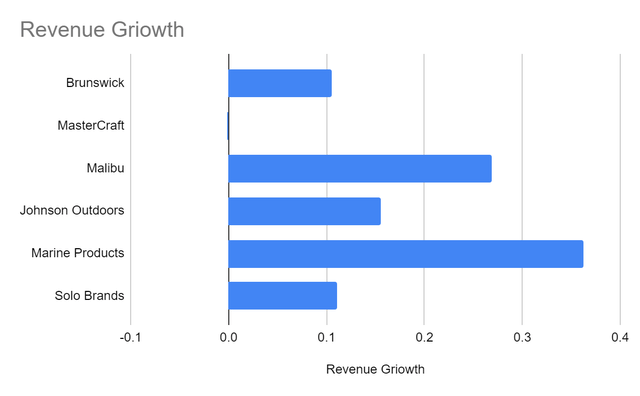

With regard to its peers, Brunswick remained a giant. It continued to dominate the market with its 62% market share. However, it seemed to have underperformed since its revenue growth was lower than the market average of 17%. It was less than half the increase in Malibu (MBUU) and Marine Products (MPX). On a lighter note, it was way better than MasterCraft (MCFT). It also sustained its revenue growth, showing that it still had more room to expand.

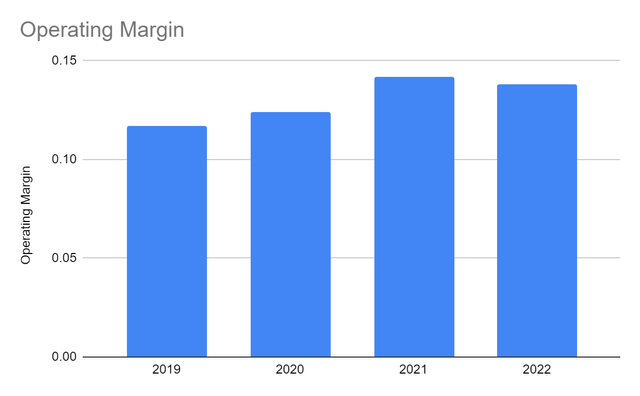

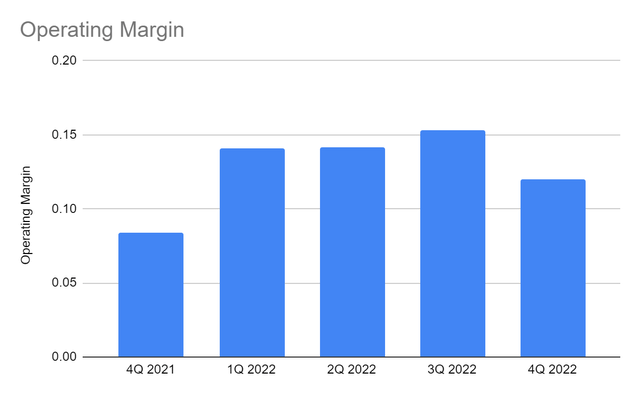

But what made Brunswick Corporation a solid company was its efficient asset management. Amidst the rising prices, it remained viable. Its strategies to sustain revenue growth were effective to cover the increase in costs and expenses. Its operating margin remained flat at 14% but higher than pre-pandemic levels. Meanwhile, its 4Q margin reached 12% versus 8% in 4Q 2021.

Operating Margin (MarketWatch)

Operating Margin (MarketWatch)

This year, Brunswick may face the same challenges as macroeconomic headwinds remain evident. The potential mild recession may also have an impact on its operations. It may be logical since boat shows will become less frequent in 3Q according to the world boat show calendar. Nevertheless, the continued relaxation of inflation may lower costs and expenses. It is a vital aspect to consider since Brunswick continues to expand internationally. Doing so can help it sustain its revenue growth and stabilize margins. We will discuss more of it in the next section.

How Brunswick Corporation May Stay Solid This Year

Amidst the pent-up demand for outdoor recreation, Brunswick Corporation faces mixed market conditions. There may be risks affecting its performance this year. First, macroeconomic volatility remains high, leading to sustained spikes in interest rates. With that, The Fed anticipates a mild recession this quarter. During the last meeting, interest rate increments were only 25 bps. They were way lower than the 75 bps increments in four consecutive quarters. Even so, the actual interest rates were elevated. This trend may raise the cost of borrowing. BC may have to be more cautious since it is also capital-intensive. Likewise, the mild recession can cause recreational boating demand to soften.

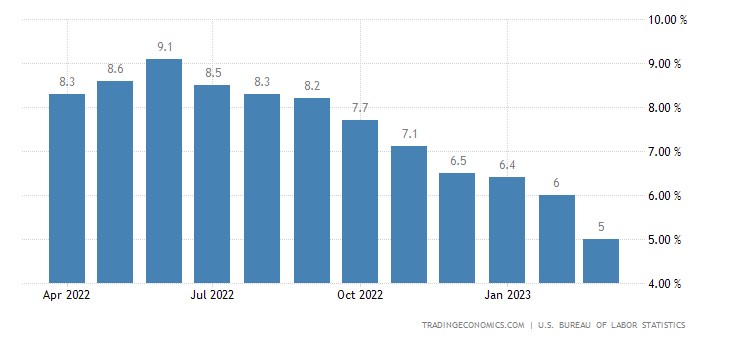

On a lighter note, market opportunities can offset or at least lessen the impact of a recession. Inflation plays a vital role in ensuring the stability of demand, costs, and expenses. And this year, inflationary changes may be favorable for the company. It is now only 5%, 45% lower than the 2022 peak of 9.1%. And while it is still higher than pre-pandemic levels, it is already the lowest value in almost two years. If the downtrend continues, it can slow down interest rate hikes and even stabilize actual rates. Market improvement is visible in gasoline prices, which are now only $3.535 per gallon versus $5.032 in 2022. Given this, recreational boating may maintain its appeal since the activity becomes less expensive. Products may also sustain their demand, given the continued decrease in inflation.

US Inflation (Trading Economics)

Another advantage of decreasing inflation lies in the continued expansion of the company. It can make its investment activities cheaper than they were in 2022. Also, it can be worth the risk since lower inflation can lead to higher demand. Since the start of the year, it has already increased its locations in Europe and Australia. It can increase its international market presence and cater to more customers. And as recreational boating goes back to normal, increasing its operating capacity can be strategic.

The reopening of China borders after the hard lockdown in 2022 may stimulate revenue growth. China is one of the primary locations of BC in Asia-Pacific. This improvement can help in its smoother operations in the region. Also, boat shows may increase this year. In turn, there may be more demand for its products while the company expands its operating capacity.

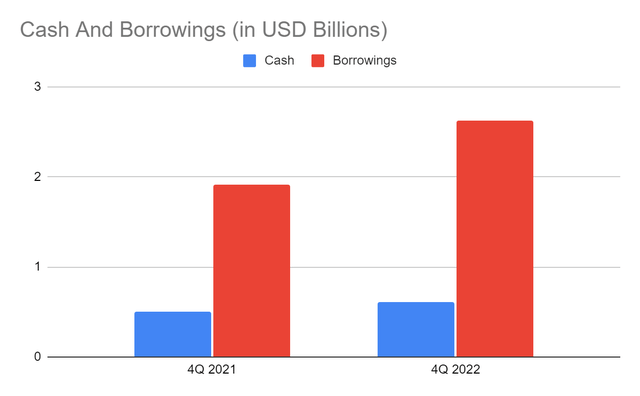

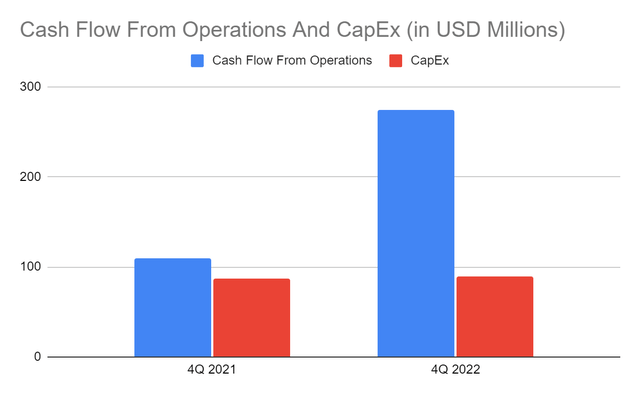

But what makes Brunswick a durable company is its excellent financial positioning. Its stellar balance sheet shows BC can sustain its operating capacity while covering capital returns. Cash reserves continue to increase, making it a liquid company. It must only watch out for its inventories as we expect a mild recession. Borrowings can also be a consent since it already increased by 38%. But given its Net Debt/EBITDA Ratio of 1.7x, it has enough earnings to cover its borrowings. Cash levels are more than enough to cover outstanding borrowings. Also, short-term borrowings and current maturities are less than 10% of the total borrowings. Indeed, the company can sustain its expansion while paying borrowings and dividends. We can confirm it with the Cash Flow Statement. Cash Flow From Operations is about thrice the value of CapEx. Its Free Cash Flow of $198 million exceeds dividend payments. Hence, Brunswick maintains the balance between viability, liquidity, and sustainability.

Cash And Cash Equivalents And Borrowings (MarketWatch)

Cash Flow From Operations And CapEx (MarketWatch)

Stock Price Assessment

The stock price of Brunswick Corporation has been in an uptrend over the past decade. There are a series of corrections, but it continues to rebound. At $85.66, the stock price is 11% higher than last year’s value. Despite this, the upside potential of the stock price remains high. The PE Ratio of 9.45x shows that the stock price is reasonably cheap. If we use the NASDAQ estimated EPS of $10.35, the target price will be $97.81. The PB Ratio agrees with it, given the current BVPS and PB/Ratio of 29 and 3.05x. If we use the current BVPS and the average PB Ratio of 3.5x, the target price will be $99.68.

Moreover, Brunswick is a decent dividend stock, given its consistent payment with yields of 1.87%. The dividend yield is higher than the S&P 400 average of 1.65%. Also, dividends are well-covered, given the Dividend Payout Ratio of 16%. Another upside driver is its high capacity of sustaining capital returns. Over the years, it has increased its capital returns. In its 2023 outlook, it aims to generate $375 million in FCF, about 90% higher than in 2022. It is possible if we take a look at the opportunities Brunswick can seize. Having a higher FCF can increase its cash reserves to cover dividends and share repurchases. To assess the stock price better, we will use the DCF Model.

FCFF $376,000,000

Cash $613,000,000

Borrowings $2,630,000,000

Perpetual Growth Rate 4.8%

WACC 9.2%

Common Shares Outstanding 71,365,000

Stock Price $85.66

Derived Value $100.08

The derived value also shows that the stock price is undervalued. There may be a 17% upside in the next 12-18 months. So, investors may take this opportunity to buy shares at a discount.

Bottom line

Brunswick Corporation remains a formidable giant amidst macroeconomic headwinds. It maintains its momentum by capitalizing on continued expansion and flexible pricing. Its strategies and efforts may pay off as inflation becomes more manageable. Today, it maintains adequate capacity to sustain its expansion and capital returns. Moreover, it is an ideal dividend stock with yields better than the S&P 400 average. Payments are consistent and well-covered. Also, the stock price is undervalued and has high upside potential. The recommendation is that Brunswick Corporation stock is a strong buy.

Leave a Reply